#COMPARE AUTO INSURANCE RATES BY ZIP CODE CODE#

This means the difference between the lowest-paying ZIP code and the highest paying ZIP code in America is a staggering $28,331.96 annually.

#COMPARE AUTO INSURANCE RATES BY ZIP CODE DRIVERS#

In Anahola, Hawaii, folks living in the 96703 ZIP code pay a low annual rate of $2,189.62.įor the lucky drivers in the 24450 ZIP code in Lexington, Virginia, your average annual rates are only $2,018.13. The 44883 ZIP code in Tiffin, Ohio pays an average of $2,325.38 per year for auto insurance.

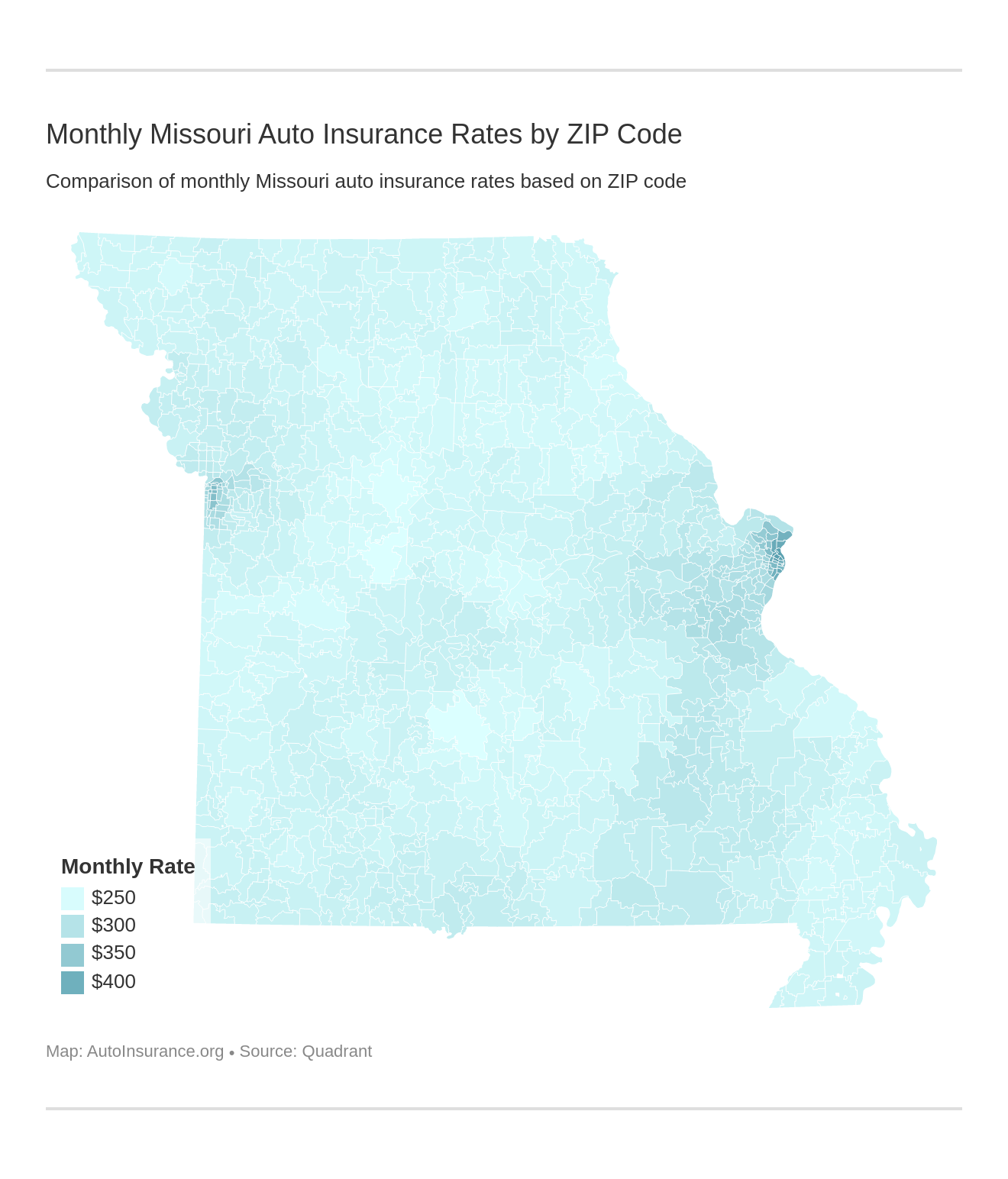

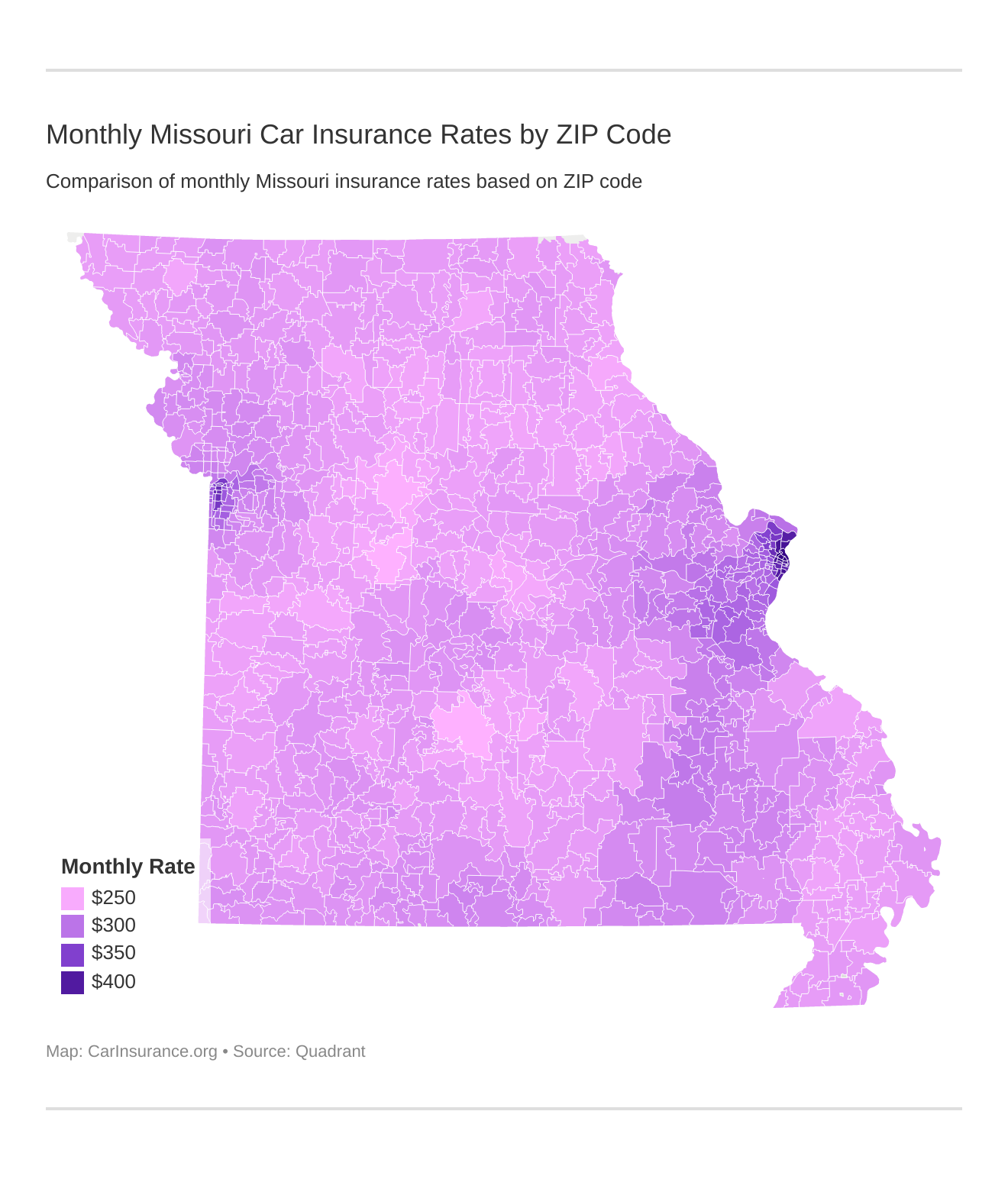

Those living in Lexington, Virginia, Anahola, Hawaii, and Tiffin, Ohio receive some of the lowest annual auto insurance rates in the country, according to our data. Lowest Average Annual Auto Insurance Rates in State Highest Average Annual Auto Insurance Rates in State In the table below, we collected the average annual auto insurance rates by state for the ZIP codes with the highest premiums. However, if you live in a lower-risk ZIP code, you’ll receive cheaper auto insurance rates. If you live in one of the higher-risk ZIP codes, your average annual insurance rates will increase. Higher rates of auto theft, fatal accidents, and denser populations are often considered higher-risk ZIP codes. Specifically, vehicle crash statistics, crime rates, and population density will be analyzed. When you do an insurance rate comparison by ZIP code, you will find that auto insurance rates can drastically change within the same local areas based on their differing ZIP codes.Īuto insurance companies will consider statistics from your neighborhood when assessing your risk. Your specific ZIP code will affect what you pay on average for auto insurance. We don’t just mean your state or city, either. One factor that has a big impact is where you live. There are a lot of factors that affect auto insurance rates. What are the cons of using ZIP codes to determine auto insurance rates?Īre auto insurance rates impacted by your ZIP code?.What are the pros of using ZIP codes to determine auto insurance rates?.Can I change my auto insurance rates by changing my ZIP code?.Are auto insurance rates the same for all ZIP codes within a state?.How can I find out the auto insurance rates in my ZIP code?.Why do auto insurance rates vary by ZIP code?.Is there anything I can do to lower the auto insurance rate for my ZIP code?.How do coverage levels affect your auto insurance rates?.

Ready to learn about a few more factors insurance companies use when calculating your rates?.What other factors affect auto insurance rates?.It is legal to base auto insurance rates on your ZIP code?.Can you compare the best auto insurance rates by ZIP code to save money on auto insurance?.How important are road conditions to auto insurance rates in a ZIP code?.How does the number of motor-vehicle accidents in a ZIP code impact your auto insurance rates?.Do crime levels impact how a ZIP code is rated by an auto insurance company?.Does living in a rural or urban area affect your auto insurance rates?.Can your ZIP code lower your auto insurance rates?.What cities and ZIP codes have the highest and lowest auto insurance rates?.Are auto insurance rates impacted by your ZIP code?.This can make it challenging to find cheap auto insurance rates in your city. In a big city, you might actually find that a simple move across the street can change your rate if it puts you in another ZIP code. When you do an auto insurance ZIP code comparison, you will find changes in auto insurance rates by city, but they can also change within a city. In fact, comparing auto insurance rates by ZIP code can produce some surprising results. The average annual costs reach a grand total of $30,350.09 in this area.Īuto insurance companies use many different variables when calculating your specific auto insurance premiums.īut does your ZIP code affect your auto insurance? It most definitely does. The most expensive ZIP code in America is 48201 in Detroit, Michigan.The least expensive ZIP code in America is 24450 in Lexington, Virginia.Crime statistics, vehicle theft rates, population density, and even road conditions will all be considered in your ZIP code. Your ZIP code will impact your auto insurance rates.

0 kommentar(er)

0 kommentar(er)